Final Expense, Critical Illness, Heart Attack & Stroke, and Hospital Indemnity Plans

of families experience hardship due to Funeral Expenses

of seniors cite medical debt as the primary reason

of seniors report not filling prescription drugs due to high costs

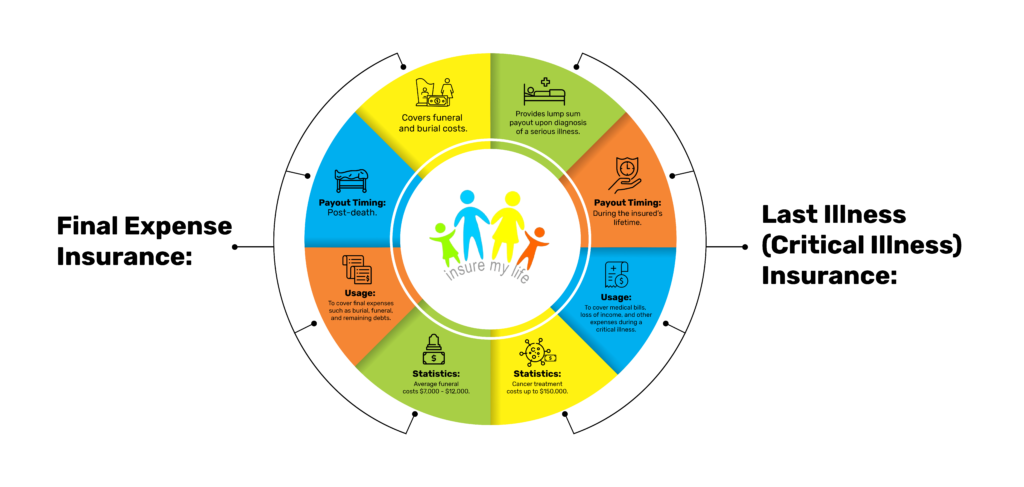

As seniors navigate the complexities of healthcare and financial planning, it’s crucial to consider comprehensive coverage that addresses both pre- and post-death needs. Combining different insurance products can help ensure that all aspects of senior care are adequately covered, providing peace of mind for both the individual and their loved ones....While final expense insurance is essential for covering costs related to end-of-life expenses such as funeral services, burial, and other associated fees, it is only one part of a complete plan. Supplemental insurances, such as critical illness insurance, heart attack insurance, and hospital indemnity plans, play a critical role in providing financial support during a senior’s life. These plans offer protection against the high costs of unexpected medical conditions and hospital stays, which can significantly impact one's savings and financial security. By integrating both final expense and supplemental insurance, seniors can ensure they are financially protected from costly medical emergencies and provide their families with financial relief from the burden of final expenses. This holistic approach not only secures a better quality of life during senior years but also eases the financial strain on loved ones after passing.

We are committed to serving the senior community with the utmost dedication and expertise. Our mission is simple yet powerful: to empower seniors with the knowledge and tools they need to make informed decisions about their financial future. We understand that your choices regarding insurance and end-of-life planning are deeply personal, so we focus on providing clear, honest, and comprehensive information tailored to your needs.

Years On

The Market

Payout Post

Death

Payout During

Your Life

Combined

Payout

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consec tetur adipiscing elit, sed do eiusmod.